Turing Network Token (TUR)

TUR is the Turing Network’s utility token and its economic fuel

Network Transactions

Powers network transaction fees and extrinsics execution

Automation Fees

Dynamic fees adjust to prioritize tasks and reduce congestion

Collator Staking

Operates and secures the network while rewarding token holders

Governance

Empowers token holders to democratically determine the direction of the network

Community DAO

Deploys a well-resourced, sovereign DAO to build, experiment, and more

Developer Incentives

Accelerates DApp and other ecosystem initiatives with grants and bounties

TUR Tokenomics

One billion TUR will be minted and distributed over a 3-year supply curve

Symbol

TUR

Initial Total Supply

1 Billion

Supply at Genesis

4.8%

Inflation

5%

Long-term Supply

Deflationary

Burn Mechanism

Gas & Fee Instant Burning

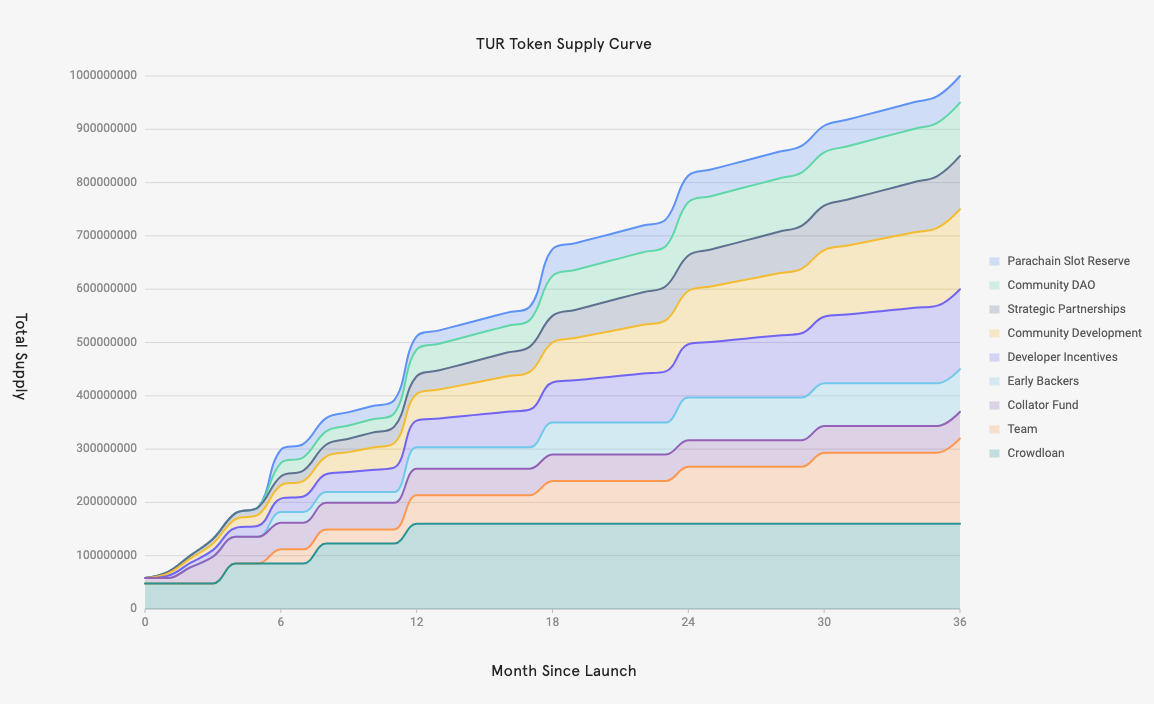

TUR Distribution

Figure 1: Categories of Turing Network token distribution

Early Backers

To compensate the backers of the early development of the Turing Network.

Allocation: 8.0%

Vesting Period: 24 months; to be distributed at the 6th, 12th, 18th and 24th months

Team

To incentivize the direct contractual workforce of the Turing Network.

Allocation: 16.0%

Vesting Period: 36 months; to be distributed at the 6th, 12th, 18th, 24th, 30th and 36th months

Initial Collator Fund

To distribute the initial funds for collators to run and maintain the security of the network.

Allocation: 5.0%

Vesting Period: 3 months; to be distributed over the first few months after Turing Network launch

Crowdloan Reward

To raise KSM in a crowdloan to win the auction of Kusama parachain slot.

Allocation: 16.0%

Vesting Period: 12 months; 30% of these tokens to be distributed shortly after launch. The remaining 70% will be distributed evenly at the 4th, 8th, 12th months.

Developer Incentives

To boost project and platform adoption among developers through a variety of programs such as open grants, bug bounties, and hackathons.

Allocation: 15.0%

Vesting Period: 36 months; to be minted each month and distributed as the tokens are earned through developer programs.

Ecosystem Growth

To drive ecosystem growth in 3 pillars: Communication, Marketing, and Community. Initiatives include Ambassador, KOL, meetups, etc.

Allocation: 15.0%

Vesting Period: 36 months; to be minted each month and distributed as the tokens are earned through growth initiatives

Strategic Partnerships

To provide free trials for partners, such as trading firms and exchanges, as well as to create initial liquidity pools for cross-chain asset transfer.

Allocation: 10.0%

Vesting Period: 24 months; to be minted each month and distributed as partners are onboarded.

Community DAO

To fully unleash the power of our community by sponsoring a DAO governed by community members.

Allocation: 10.0%

Vesting Period: 24 months; to be minted and distributed evenly at the 6th, 12th 18th and 24th months

Future Parachain Reserve

To be reserved for future parachain slots of Kusama. This fund will also be supplemented through the 1.5% annual inflation.

Allocation: 5.0%

Vesting Period: 24 months; to be minted and distributed evenly at the 6th, and 18th months.

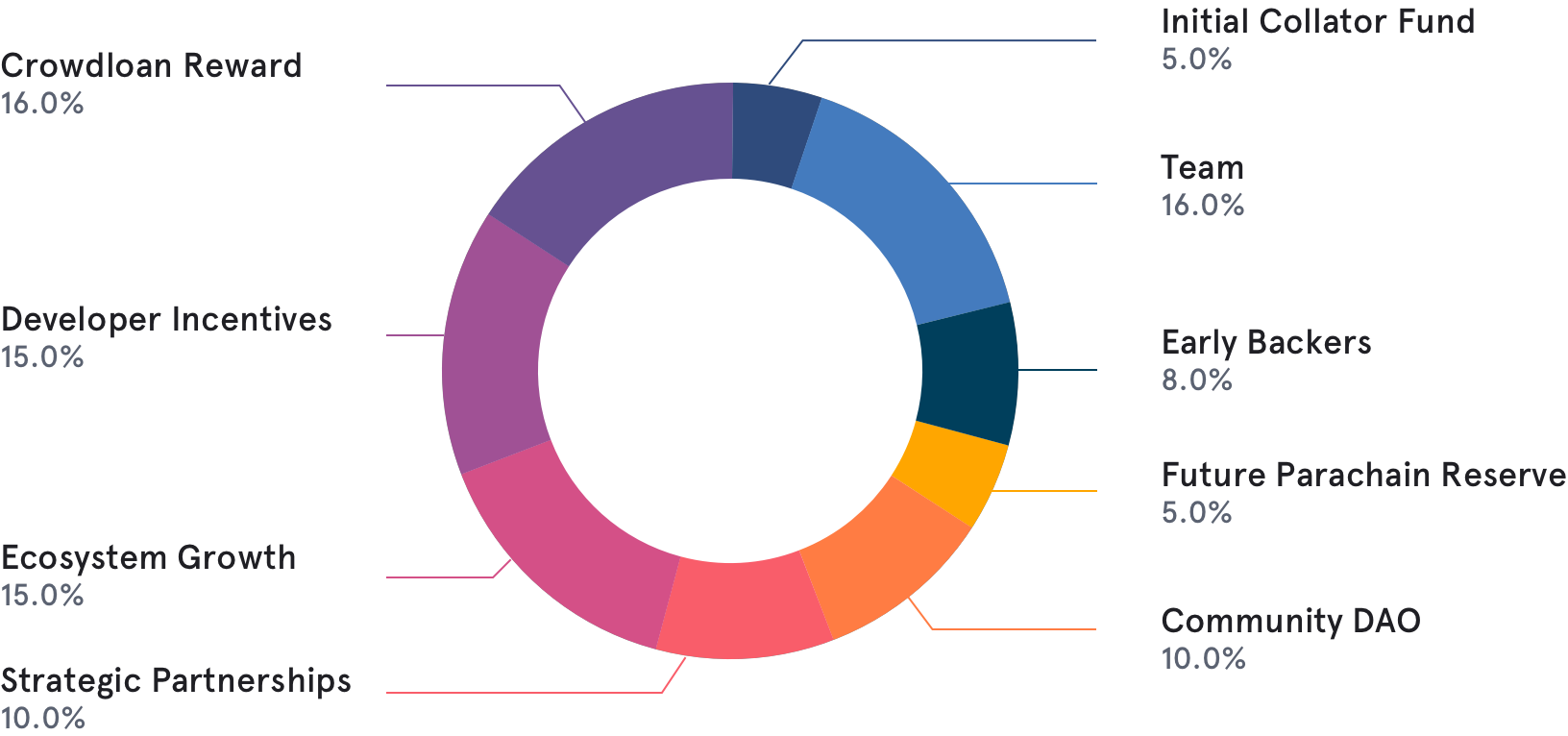

Circulating Supply Curve

The above vesting schedules correspond to the following TUR circulating supply curve

TUR Token Release Schedule

Figure 2: TUR token distribution schedule and circulating supply curve

Token Inflation

Inflation is subject to a fixed 5% inflation rate divided into 3 components:

1% is used for Collator rewards

2.5% is used for staking rewards

1.5% is used for subsequent Parachain Slots

This inflationary force will be constant throughout the duration of the network’s life apart from the first 2 months. Additionally, it will be counterbalanced through burning of transaction fees which are expected to result in the token becoming slightly deflationary over time.

Due to OAK Network onboarding collators over the first 2 months, staking and collator rewards will not be granted. Therefore inflation will not be activated for the first 2 months of the TUR launch.

TUR Staking Rate of Return as a Function of Time

Figure 3: TUR staking rate of return based on the assumption that 10% of vested tokens are staked. The Token Distribution Event of Turing Network occured on April 4, 2022.

CALL TO ACTION

Sign up for our news

Sign up with an email address to stay up to date with the latest information on the OAK Network.